Page 29 - Layout 1

P. 29

S COVER STORY

ducing wind power has fallen dramatically

across the globe, by reducing the cost of OFFSHORE WIND FORECAST

equipment and the cost of capital.”

He believes that wind power developers

are looking for government assistance to resolve

long-standing issues regarding imbalances in

PPAs, local regulatory barriers, and uncertain

processes for land and licensing. That is par-

ticularly true of offshore wind development,

where the scale of investment is huge and the

risk for investors must be moderated if Vietnam

is to achieve its wind power goals.

“Wind power in Vietnam is still in its

infancy and this reduction in future income

from power plants may limit the market to

those developers with access to very cheap

capital and who have experience in the coun-

try’s wind power market,” Mr. Smith empha- Source: RCG’s Global Renewable Infrastructure Project

sized. “That may block Vietnamese companies

from entering the booming market and make

international developers dominant.” said. But it is also necessary to consider that its twin goals of moderating greenhouse gas

Meanwhile, total solar power capacity current implementation cycles, which are emissions and having secure, reliable power

(including floating) put into operation as of under discussion, are still too short for many supply at a predictable cost.

the end of 2020 totaled some 17GW, primarily large-scale projects. The government, Mr. Smith proposed,

in southern and central highlands provinces. Construction and commissioning phases must also look beyond the singular view of

“Transmission grids lack the quality, especially take time in Vietnam. Realistically, an onshore large wind farms selling electricity to Electricity

in Ninh Thuan and Binh Thuan provinces, to wind project will need at least two years to of Vietnam (EVN) and deliver on its promise

accommodate the increasing number of solar move from the investment licensing stage to to allow power consumers direct access to

power projects and reductions in construction the COD, depending on the number of wind clean energy through the delayed “Direct

time due to advanced technology,” said Dr. turbines. Meanwhile, banks need a valid FiT PPA Pilot Scheme” and to remove the heavy

Oliver Massmann, General Director of Duane and a bankable PPA. The FiT mechanism, there- regulations blocking more on-site “Behind

Morris. “As a result, most projects that have fore, needs to be announced on time for project the Meter” power plants that sell power

come into operation in these localities are investors to prepare, Mr. Wasnick suggested. directly to large power consumers.

subject to daily declines in generation capacity Meanwhile, the GGSC and GWEC wrote It is expected that the expansion of onshore

to avoid overloading the regional grid. to the government last year to call for a clear, and nearshore wind projects will increase sig-

long-term commitment to buy wind-powered nificantly, and the manufacturers of wind tur-

Solutions proposed electricity that would allow developers to bines have reported incoming orders amounting

Since Covid-19 remains a threat globally invest the necessary billions of dollars with to around 2.3GW. Mr. Wasnick, though, said

and Vietnam is dependent upon international confidence that Vietnam is a strong and com- that whether these projects reach the financial

supply chains, projects that already have a mitted partner in clean energy. If developers closing on time and are delivered, commis-

PPA should be given more time to secure see reasonable treatment and support from sioned, and put into operation on time is

financing and be subject to some flexibility MoIT, onshore and offshore wind could make difficult to predict. Logistical bottlenecks are

with regard to planned CODs, Mr. Wasnick a huge contribution to the country meeting to be expected, which could lead to delays. %

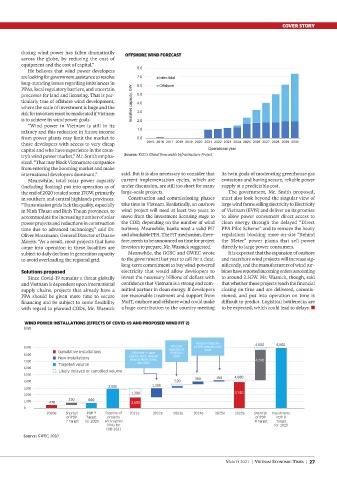

WIND POWER INSTALLATIONS (EFFECTS OF COVID-19 AND PROPOSED WIND FiT 2)

MW

Forecast reduction 4,500 8,500

9,000 Forecast of 25% annually until

reduction of 2025

Cumulative installations 2,900 MW is upper 60-80% in

8,000 case for 2021; delayed 2023

New installations

7,000 projects likely to slip 4,240

into 2022

Targeted volume

6,000

Likely delayed or cancelled volume

5,000

390 190 4,000

4,000 520

2,900 1,300

3,000

1,300 3,740

2,000

330 800

1,000 470 2,600

0

2020e Shortall PDP 7 Pipeline of 2021e 2022e 2023e 2024e 2025e 2025e Shortfall Preliminary

of PDP Target projects of PDP PDP 8

7 Target for 2020 with signed 8 Target Target

PPAs for for 2025

COD 2021

Source: GWEC, 2020

MARCH 2021 | VIETNAM ECONOMIC TIMES | 27