Page 37 - Layout 1

P. 37

F

5

BANKING & FINANCE

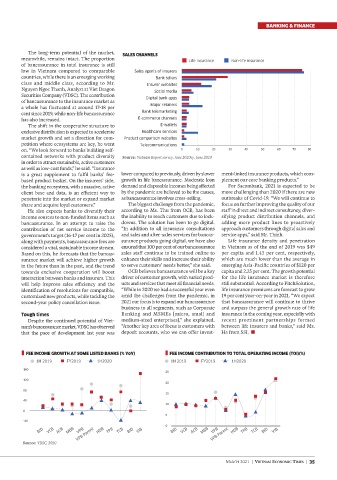

The long-term potential of the market, SALES CHANNELS

meanwhile, remains intact. The proportion Life insurance Non-life insurance

of bancassurance in total insurance is still

low in Vietnam compared to comparable Sales agents of insurers

countries, while there is an emerging working Bank tellers

class and middle class, according to Mr. Insurer websites

Nguyen Ngoc Thanh, Analyst at Viet Dragon

Securities Company (VDSC). The contribution Social media

of bancassurance to the insurance market as Digital bank apps

a whole has fluctuated at around 17-18 per Major retailers

cent since 2019, while non-life bancassurance Bank telemarketing

has also increased. E-commerce channels

The shift in the cooperative structure to E-wallets

exclusive distribution is expected to accelerate Healthcare services

market growth and set a direction for com- Product comparison websites

petition where ecosystems are key, he went Telecommunications

on. “We look forward to banks building self- 0 10 20 30 40 50 60 70 80

contained networks with product diversity Source: Vietnam Report survey, June 2020ey, June 2020

in order to attract sustainable, active customers

as well as low-cost funds,” he said. “Insurance

is a great supplement to fulfil banks’ fee- lower compared to previously, driven by slower ment-linked insurance products, which com-

based product basket. On the insurers’ side, growth in life bancassurance. Moderate loan plement our core banking products.”

the banking ecosystem, with a massive, active demand and disposable incomes being affected For Sacombank, 2021 is expected to be

client base and data, is an efficient way to by the pandemic are believed to be the causes, more challenging than 2020 if there are new

penetrate into the market or expand market as bancassurance involves cross-selling. outbreaks of Covid-19. “We will continue to

share and acquire loyal customers.” The biggest challenge from the pandemic, focus on further improving the quality of our

He also expects banks to diversify their according to Ms. Thu from OCB, has been staff in direct and indirect consultancy, diver-

income sources to non-funded items such as the inability to reach customers due to lock- sifying product distribution channels, and

bancassurance. In an attempt to raise the downs. The solution has been to go digital. adding more product lines to proactively

contribution of net service income to the “In addition to all insurance consultations approach customers through digital sales and

government’s target (16-17 per cent in 2025), and sales and after-sales services for bancas- service apps,” said Mr. Thinh.

along with payments, bancassurance fees are surance products going digital, we have also Life insurance density and penetration

considered a vital, sustainable income stream. ensured that 100 per cent of our bancassurance in Vietnam as of the end of 2019 was $49

Based on this, he forecasts that the bancas- sales staff continue to be trained online to per capita and 1.43 per cent, respectively,

surance market will achieve higher growth enhance their skills and increase their ability which are much lower than the average in

in the future than in the past, and the trend to serve customers’ needs better,” she said. emerging Asia-Pacific countries of $120 per

towards exclusive cooperation will boost OCB believes bancassurance will be a key capita and 2.25 per cent. The growth potential !

interaction between banks and insurers. This driver of customer growth, with varied prod- for the life insurance market is therefore

will help improve sales efficiency and the ucts and services that meet all financial needs. still substantial. According to FitchSolution,

identification of resolutions for compatible, “While in 2020 we had a successful year even life insurance premiums are forecast to grow

customized new products, while tackling the amid the challenges from the pandemic, in 19 per cent year-on-year in 2021. “We expect

second-year policy cancellation issue. 2021 our focus is to expand our bancassurance that bancassurance will continue to thrive

business to all segments, such as Corporate and surpass the general growth rate of life

Banking and MSMEs [micro, small and insurance in the coming year, especially with

Tough times

Despite the continued potential of Viet- medium-sized enterprises],” she explained. recent prominent partnerships formed

nam’s bancassurance market, VDSC has observed “Another key area of focus is customers with between life insurers and banks,” said Ms.

that the pace of development last year was deposit accounts, who we can offer invest- Ha from SSI. %

FEE INCOME GROWTH AT SOME LISTED BANKS (% YoY) FEE INCOME CONTRIBUTION TO TOTAL OPERATING INCOME (TOI)(%)

1H 2019 FY2019 1H2020 1H 2019 FY2019 1H2020

160

25

120

20

80

15

40

10

0

5

-40

0

BID VCB ACB MBB VPB Parent HDB TPB TCB BID VIB BID VCB ACB MBB VPB Parent HDB TPB TCB BID VIB

VPB

VPB

Source: VDSC, 2020

MARCH 2021 | VIETNAM ECONOMIC TIMES | 35

S

L